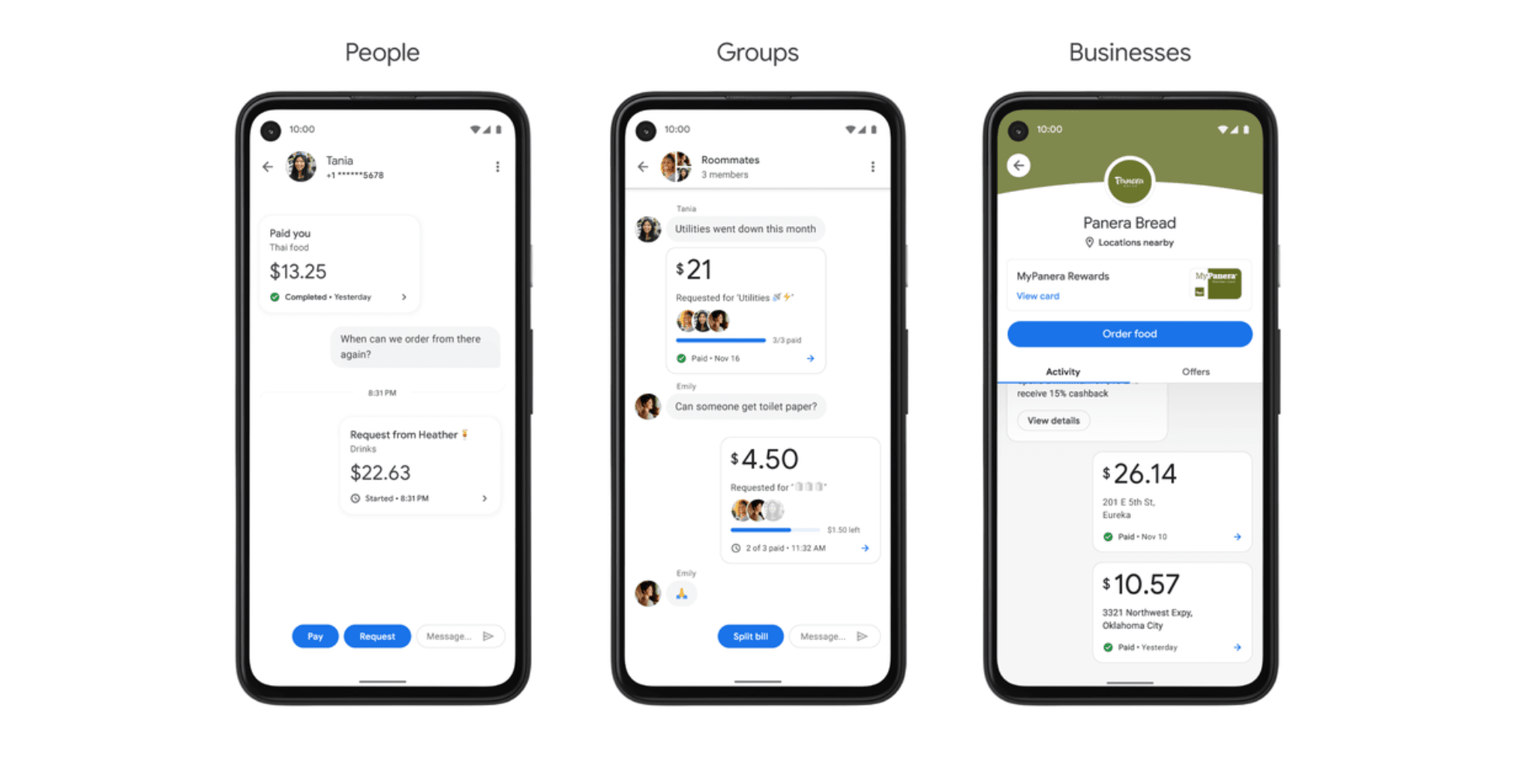

In Google’s own words “the new app is designed around your relationships with people and businesses,” and “it helps you save money and gives you insights into your spending.” Next year, you’ll also be able to apply for a Google bank account, something we first saw rumored about a year ago. Google Pay’s old app is divided into a few tabs showing your collection of cards and recent transactions. The new app instead almost behaves like a messaging app within its home tab, letting you see the people and businesses you exchange money with most often.

Click on a person or group of people, for instance, and you will see transactions arrayed in chat-like bubbles. You are given the option to pay, request money, or split a bill, but you can also message them right within the app. In group “chats,” you can see who has contributed to a split bill and who hasn’t; that’ll help you stop that one friend who tries to get away with not paying for dinner. In the case of businesses, you can see your recent activity, as well as have quick access to your rewards card and offers. It seems Google is also planning on turning Google Pay into something of a coupon hub as well, allowing you to apply promo codes with a tap and have them automatically applied when shopping at a business.

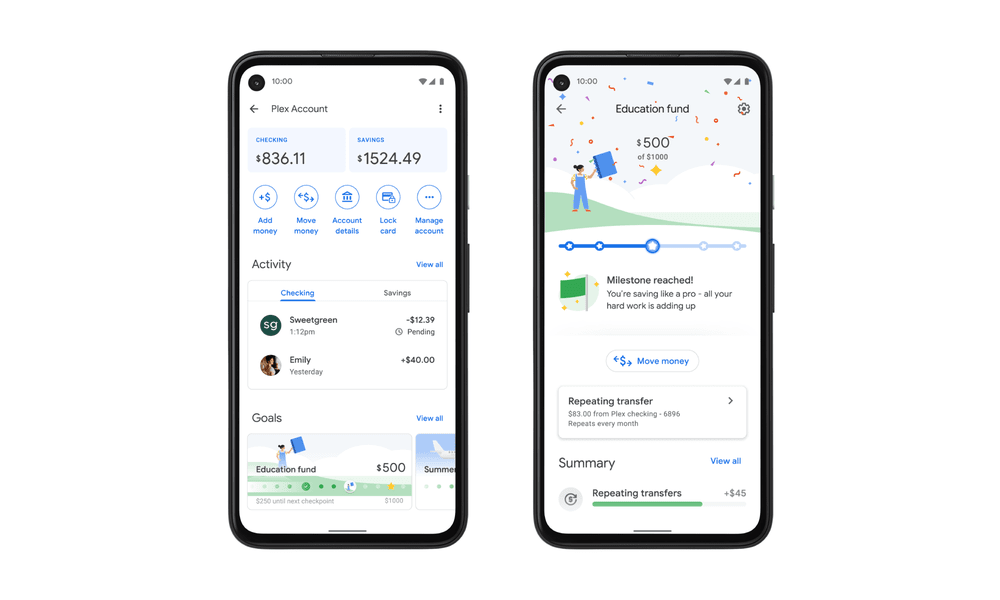

The more interesting updates are in the app’s new financial management system. If you connect your bank and cards to the app, you can see spending trends and insights to let you know if you’re using up too much money on tacos. Really, you can look up “Mexican restaurants,” for instance, as well as things like “groceries” or “last month” to get a clearer idea of your finances. Google can likely leverage the huge amount of business data it’s amassed over the years to provide a more accurate picture of your spending. Lastly, the company says it will launch “mobile-first” Plex accounts in 2021. These bank accounts are administered by established banks and credit unions, starting with 11 institutions next year, but with a Google twist.

The company says the checking and savings accounts offer “no monthly fees, overdraft charges or minimum balance requirements and help you save toward your goals more easily.” There’s little other information for now though.

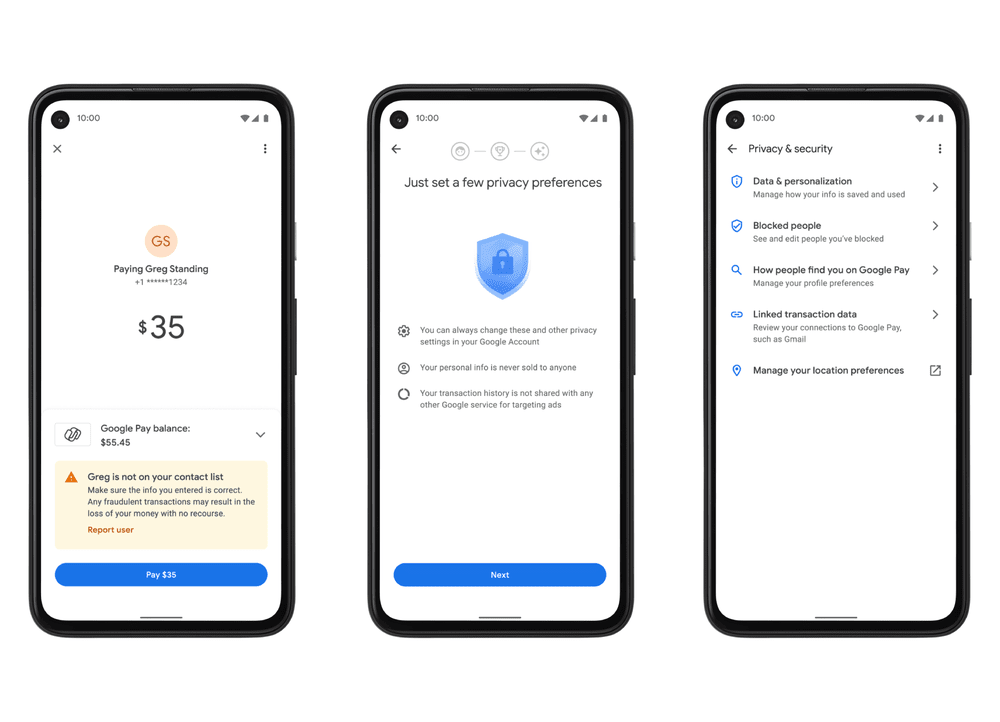

Of course, Google is far from the only app to provide such insights. The proof will be in the pudding to see whether it can be any better than existing options, but Google Pay does have a bit of a home-field advantage in that it’s the same app you might already be using for sending money or contactless payments. Then there’s the matter of whether you’d actually trust Google with so much information about your spending. The company says it has built-in safety features like alerting you if you’re sending money to the wrong person, and it offers a series of privacy controls to customize your experience.

Google says it “will never sell your data to third parties or share your transaction history with the rest of Google for targeting ads.” That last part is particularly important, but it remains to be seen whether people will be able to get over handing over more information to the big G; not the least because Google has a built a reputation for killing off projects. The changes are rolling out starting today on Android and iOS in the US first, with other regions to follow.