From your weight to your money, there’s a tracking app for everything nowadays. Sure, they can make our lives more convenient, and they give us a sense of control, but just the fact that they exist doesn’t mean we should actually use them. In fact, some are simply abusing our laziness to gather personal information for commercial purposes. Recently, millennials have been bombarded with a slew of new personal finance apps. It seems as if budgeting, saving, and investing is all the rage nowadays, and that everyone’s aiming for FIRE (Financial Independence Retire Early). But again, you don’t really need a fancy app to do all of that.

Manage your personal budget with Google Sheets

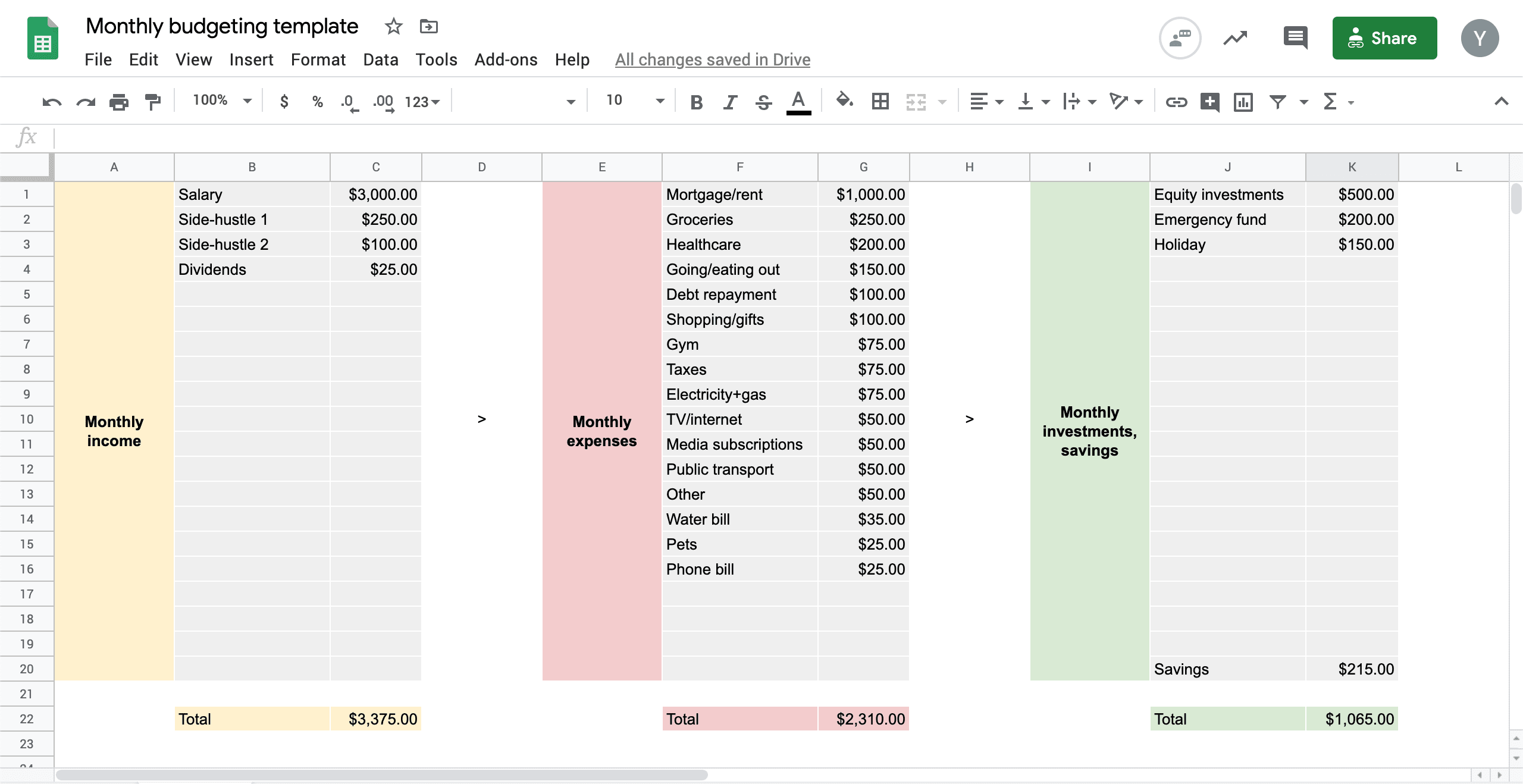

There are lots of budgeting spreadsheet templates available on the web. Many of them require quite a bit of work, like filling in all of the specific transactions you conduct. However, that isn’t really necessary for a consistent, personal budget, especially if you have a fairly consistent stream of income and expenses. So we’re here to provide you with an accessible way to budget — a very simple though effective (if you stick to it, of course) template; one that doesn’t require much maintenance, and still gives you a concise glance at what comes in, what goes out, and how much you’re saving per month. Read on after the preview.

Most of the work is done upfront, after that it’s just a matter of keeping it up to date. First, you’ll have to figure out all of your monthly recurring income streams and expenses and fill that in next to ‘Monthly income’ and ‘Monthly expenses’ respectively. With that, you’ll get a better grip over your money: you can see how you spend your money, where you might be able to cut spending, and how all that influences what you have left to save (i.e. for an emergency fund, or a holiday), or invest. [Read: Holy sheet: How to track your stock portfolio with Google Sheets] The basic template doesn’t use a lot of complicated formulas. In fact, it only uses formulas to (1) calculate the sum of your income, expenses, and savings/investments per month, and (2) to calculate the left-over savings (after other savings and investments) in cell K20. So you won’t have to touch those four cells. Feel free to check it out, make a copy of the sheet (File > Make a copy), and start playing with it yourself.